Key Concepts in Bookkeeping Klgktth

Bookkeeping is a crucial component of financial management that involves meticulous record-keeping and understanding essential terminology. Accurate documentation of transactions aids in decision-making and regulatory compliance. Additionally, core financial statements, such as the income statement and balance sheet, provide insights into a business's profitability and liquidity. The nuances of effective bookkeeping practices can significantly impact an organization's growth trajectory. Exploring these concepts further can reveal strategies for enhancing financial oversight.

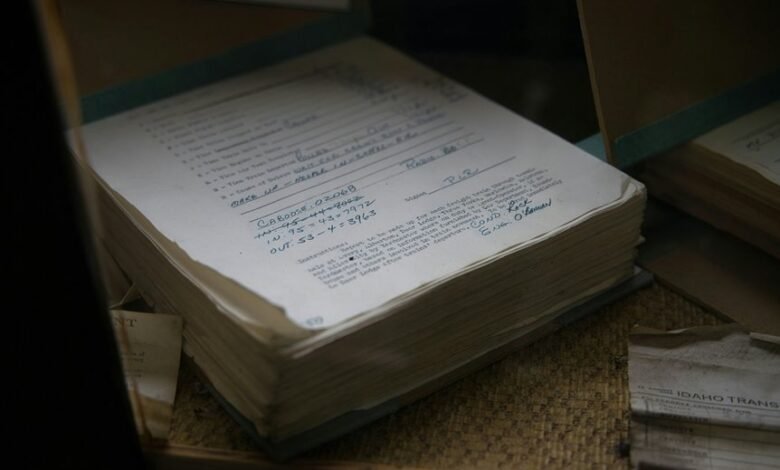

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundational framework for any business's financial management system.

It encompasses essential bookkeeping terminology and effective ledger management, ensuring that all financial transactions are accurately recorded and organized.

The Importance of Accurate Record Keeping

Accurate record keeping is critical to the financial health of any organization. It ensures record accuracy, which is essential for maintaining financial integrity.

When organizations prioritize precise documentation, they empower themselves to make informed decisions, comply with regulations, and foster trust with stakeholders.

Ultimately, effective record keeping not only protects assets but also enhances the freedom and flexibility necessary for sustainable growth.

Key Financial Statements Explained

Financial statements serve as the backbone of any organization's financial reporting framework, providing a structured overview of its financial performance and position.

Key components include the income statement, balance sheet, and cash flow statement, each offering insights into profitability and liquidity.

Tips for Effective Bookkeeping Practices

While maintaining meticulous records may seem daunting, employing effective bookkeeping practices can significantly enhance an organization's financial management.

Utilizing digital tools streamlines data entry, ensuring accuracy and accessibility. Establishing efficient workflows minimizes errors and saves time, allowing business owners to focus on growth.

Regular reconciliations and timely updates further reinforce financial integrity, fostering a transparent environment that empowers decision-making and promotes freedom in financial planning.

Conclusion

In the grand tapestry of financial management, bookkeeping emerges as the unsung hero, wielding the power to transform chaos into clarity. Accurate record-keeping is not merely a task; it is the lifeblood of informed decision-making and organizational integrity. The trifecta of financial statements—income statement, balance sheet, and cash flow statement—acts as a compass, guiding businesses through the stormy seas of economic uncertainty. Embracing effective bookkeeping practices is not just advisable; it is essential for sustainable success and growth.